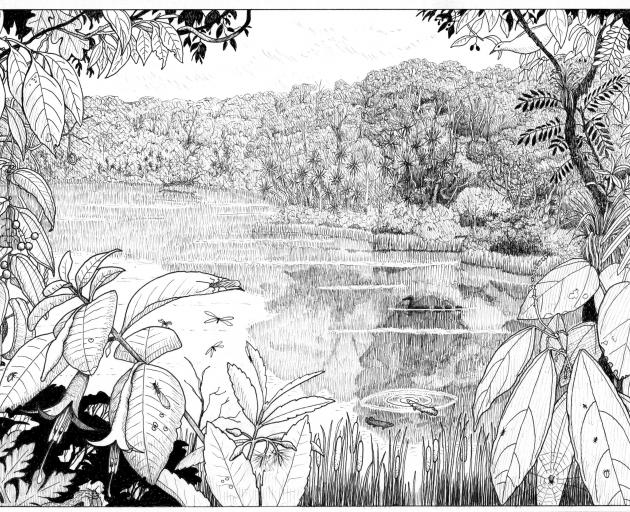

The Foulden Maar site contains fossils which are 23 million years old. Photo: Kimberley Collins CC BY-SA 4.0

environment

Fossil-mining company broke with millions in the bank

Insolvency documents for fossil-mining company Plaman Resources show there are millions in the bank and few current liabilities.The offshore company, which had plans to mine a fossil-laden maar in Middlemarch for diatomite, quietly went into receivership late last week.

When information from a leaked Goldman Sachs report hit the press, local support for the project dissipated and public outrage grew.

The reason for receivership given in a newly-released insolvency document is delays in an application to the Overseas Investment Office (OIO) to acquire land adjacent to land already owned. The additional land would allow space for infrastructure for the mining operation.

A condition of the OIO application was a corporate reorganisation to remove the majority shareholder, Malaysia’s Iris Corporation.

The insolvency document states: “The directors advise that, as a result of previously publicised delays in OIO consent, the Company was unable to acquire the adjacent land, nor complete the corporate reorganisation required to secure new capital.”

Current assets are listed at $18 million, $17 million of which is in a trust account of a US law firm. Non-current assets, such as land and mining and exploration permits are listed at being worth over $10 million.

Current liabilities are $1.63 million.

What appears to be the issue is what’s listed on the balance sheet as a non-current liability - a $32 million loan from Goldman Sachs.

Taking this into account puts the company around $5 million in the red.

It's been previously reported Goldman Sachs was the exclusive financial advisor of the company as it tried to secure more funds.

The loan has been reported as a “bridging loan” and repayments would not be needed until May 2020. It was structured so Plaman Resources could raise $50 million for their business needs before it would be required to pay Goldman Sachs back.

It’s not known what interest rate and conditions were on the loan and whether Goldman Sachs called the loan in, or if Plaman Resources decided it wouldn’t be able to raise the funds to repay it. The statement from the receiver’s KordaMentha says Plaman Resources “directors asked that receivers be appointed”.

Damaging report from Goldman Sachs

Ironically it was the leaking of a Goldman Sachs report which led to the souring of public opinion. The 112-page report has been described as appearing to be prepared for investors in the project.

The leaked report was contemptuous of local opposition to the mine and said no social or community issues were expected:

“Any appeal to the Environment Court is likely to come from a small number of local residents, who are not well-resourced and will not have comprehensive technical reports to the same extent at Plaman Global would have.”

It also said Dunedin City Council was “pro-mining”.

Dunedin's Mayor Dave Cull responded with a letter to Plaman Resources demanding the company explain itself and provide him with a copy of the report.

“The media report that the Goldman Sachs report suggests a number of ways that your company can ‘manage’ media and local communities. This includes suggesting locals are poorly-resourced to fight any proposal, which also left me concerned about how forthright you have been with information to us.

“The media reports appear to show that the full extent of the environmental impacts and loss of "pre-eminent" fossil cache at the Foulden Maar were not adequately disclosed at the presentation you gave us last year. At the presentation, we were given the impression that the site only contained black diatomaceous earth, and now we have information that it could contain fossil records of incalculable value. As such, we would like your assurance the site contains only black diatomaceous earth as it has a strong bearing on the support we continue to give.”

He did not receive a copy of the report - only a brief look - and later revoked the support he had previously provided to the OIO.

The leaked report also indicated the entirety of the deposit would need to be mined. This caused scientific outrage which bled into a public backlash. Social licence evaporated.

Letters of support for OIO process were revoked or updated. The University of Otago issued a formal statement and over 10,000 people signed the Save Foulden Maar petition.

The abrupt loss of support may have been seen as reducing the likelihood investors would get on board.

Plaman Resources needed US$300 million capital to build the mine and processing plant and get to stage one of the proposed project. This would allow them to produce 250,000 tonnes of product per year. Once underway, it was expected profits would be used to take the project to full capacity of 500,000 tonnes of processed diatomite a year.

Various consents to proceed with the project would need to be gained from the Dunedin City Council, Clutha District Council and Otago Regional Council. With the high level of public interest in the project following the leaked report, consents would likely face challenges and delays.

Iris Corporation

Iris Corporation, the Malaysian-owned majority shareholder of Plaman Resources has experienced rough times of late. Originally, the company specialised in digital identification projects, such as e-passports. Its attempt to diversify into agriculture was not successful.

It has been getting rid of what it describes as non-core assets which it said were “bleeding the company dry”. Plaman Resources is one of the assets, however Iris CEO has said there will be no “fire-sale”.

The connection with Iris Corporation was also seen as a “sensitivity” for New Zelanders, according to the leaked report, because of links to palm oil plantations. The report said guaranteeing the removal of Iris Corporation as the majority shareholder “will be viewed positively” by ministers.

In a letter to MP Clare Curran, Plaman Resources indicated its intent to buy out Iris Corporation’s shares. The money was there, but lender approval was required and the OIO application appeared to be crucial.

“We currently have the full amount of funds required to buy back Iris’ shares in our bank account, and once we receive OIO consent and the approval of our lender, the funds will be released and Iris will no longer be a shareholder in Plaman and will no longer have any representatives on Plaman’s board of directors.”

The assets and creditors

Along with money in bank accounts, Plaman’s assets include the 42 hectares in Middlemarch the company currently owns listed as worth around $630,000 and mining and exploration permits listed at $4.9 million. A $550,000 deposit on a land purchase was also listed.

Secured creditors listed include Goldman Sachs and an Auckland-based container company. The company said it would be retrieving the single container Plaman Resources rents on a monthly basis.

Further creditors include Merril Corporation Singapore, Google Australia and O’Kane Consultants. O’Kane specialises in dealing with the waste from mining operations and would not comment on how much it was out of pocket.

The other creditors are family trusts of the founders Peter Plakidis and George Manolas. Both Plakidis and Manolas were also listed as employees.

Other employees were employed through subsidiary companies. Plaman Services in Austrailia employed two people, and Plaman Services in New Zealand employed one person. Both companies are in liquidation.

Full circle

All options are on the table according to a statement from receivers KordaMentha.

“The receivers are currently assessing options for the company and its assets. All options will be considered, ranging from recapitalisation to a potential full or partial sale of the company’s assets.”

Opponents to the mining proposal hope there’s now a chance the land can be put into public ownership and protected.

If a buyout is offered it will be full circle for Plaman Resources, which acquired the land and mining rights when the former owners Featherston Resources went bust.

A former shareholder of Featherston Resources describes his personal view of Plaman Resources’ conduct in the purchase as “clever, but not actionable”.

Plaman was originally brought in to help secure finance for the troubled operation. It then resigned from the role and made a buyout offer for the company on behalf of the Malaysian-owned Iris Corporation.

Plaman Resources ended up being one of nine defendants in an Australian court case around the demise and sale of the prior owners of the mine Featherston Resources.

The plaintiffs, 12 former shareholder of Featherston Resources, sought a number of court orders including: “an account by Plaman of profits derived from its role in proposing the DoCA [deed of company arrangement], on the basis that having been given a mandate to raise capital for FRL [Featherston Resources Ltd], it resigned it on December 4, 2013 and then used the knowledge it had acquired to propose the DoCA on behalf of Iris.”

Plaman Resources filed a court order against the case being held in Australia, claiming New Zealand would be a better location. The proceedings were dismissed and the case was not pursued in New Zealand.

Overseas investors hoping the third time would be a charm for diatomite mining at Foulden Maar would need to gain approval from the OIO to purchase the 42-hectare site.

With the scientific value of the site now widely known, any application is likely to receive considerable public interest.

Read more:

Hope as fossil site claims second mining company scalp

Foulden Maar fight rumbles on

Financial offers dangled for fossil mine support

Scientists reject fossil land swap

Southern discomfort at fossil mining plans

Answers from the fossil miner

Unjustifiable vandalism and grand promises

Fossil-dirt nutrition claims under doubt

Dunedin Mayor demands facts from fossil-mining company

Who is the fossil mining company?

Opposition grows to fossil mining project

Dunedin's 'Pompeii' to be mined to make pig food

Comments

Newsroom does not allow comments directly on this website. We invite all readers who wish to discuss a story or leave a comment to visit us on Twitter or Facebook. We also welcome your news tips and feedback via email: contact@newsroom.co.nz. Thank you.